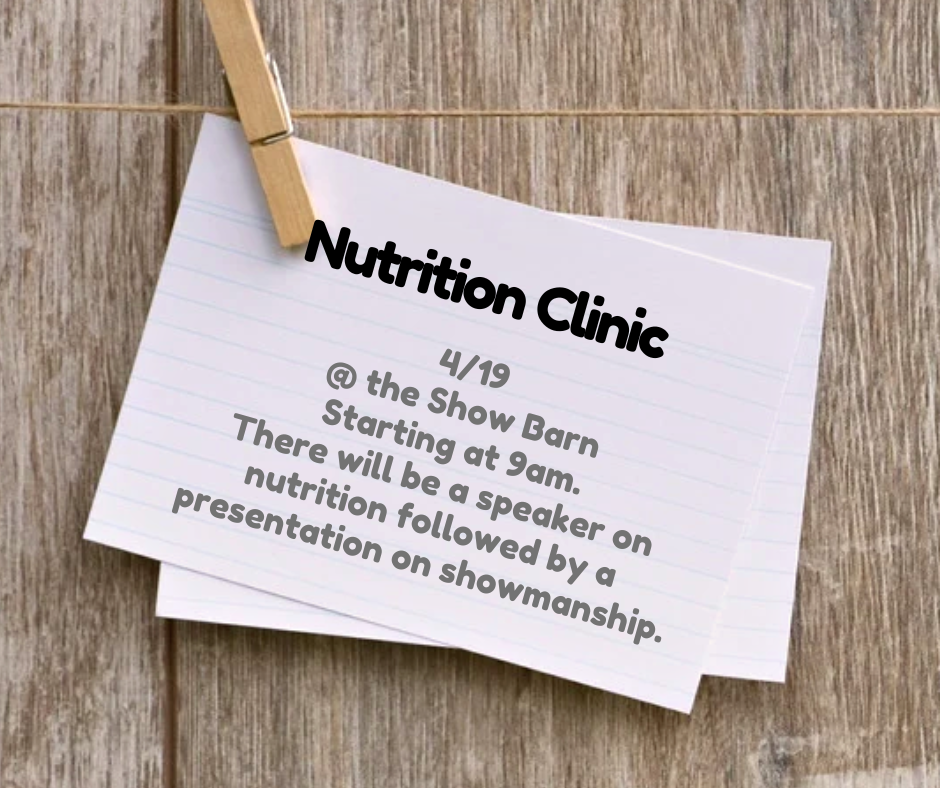

Nutrition Clinic

4/19/25

@ the Show Barn

Starting at 9am.

There will be a speaker on nutrition followed by a presentation on showmanship

Sunday August 3rd, 2025 – Day’s Events

Welcome to the 2nd day of the 2025 Newaygo County Fair! Today we have the

County Fair: Aug 2-9, 2025

Share

Nutrition Clinic

4/19/25

@ the Show Barn

Starting at 9am.

There will be a speaker on nutrition followed by a presentation on showmanship

Welcome to the 2nd day of the 2025 Newaygo County Fair! Today we have the

Welcome to the first day of the 2025 Newaygo County Fair! Today’s Day Sponsor is

I’m getting so excited to see you and your rabbits, it’s almost fair time! I

Starting Thursday morning, July 31, at 10, stop into the fair office for your camping

"*" indicates required fields