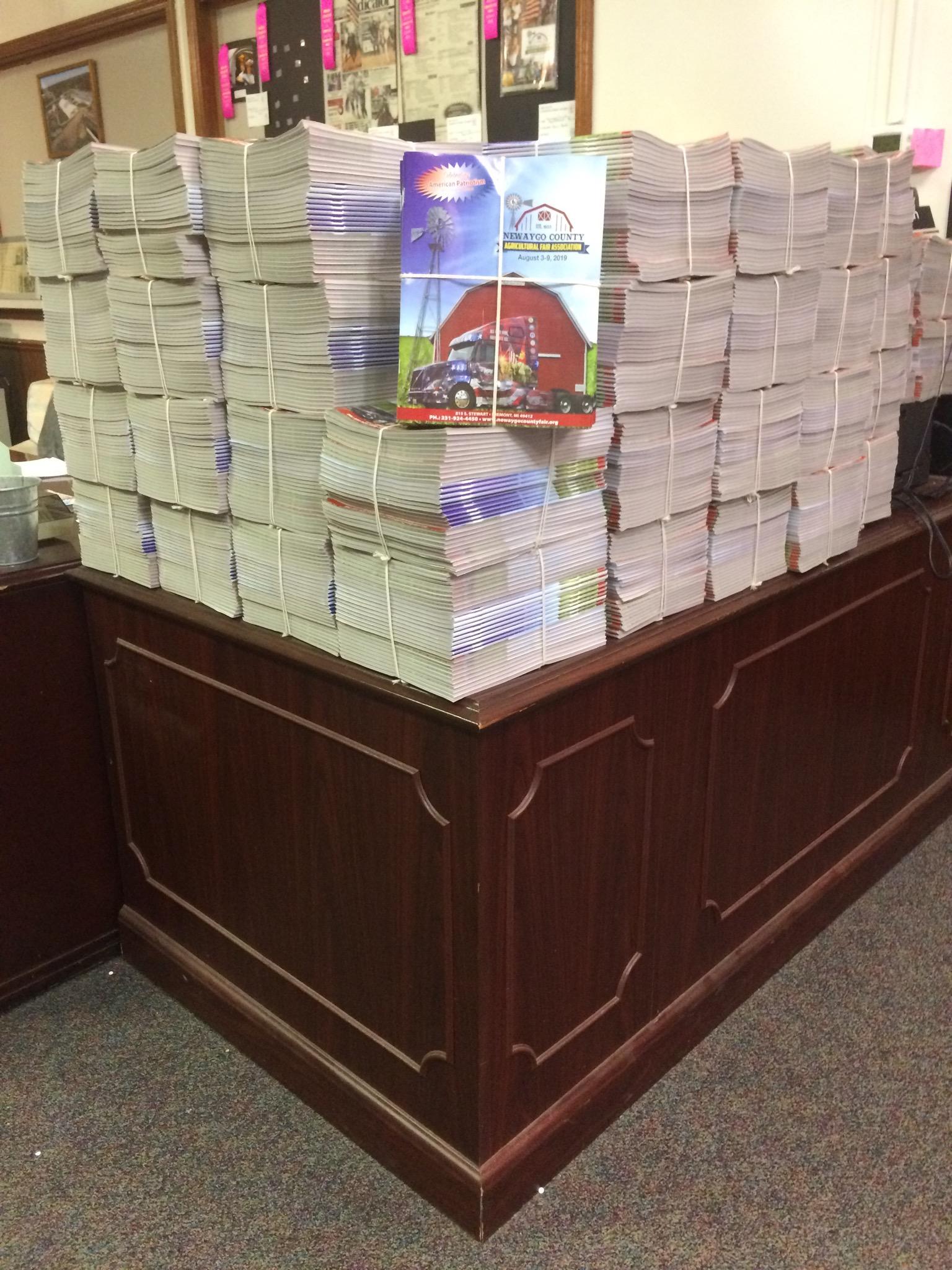

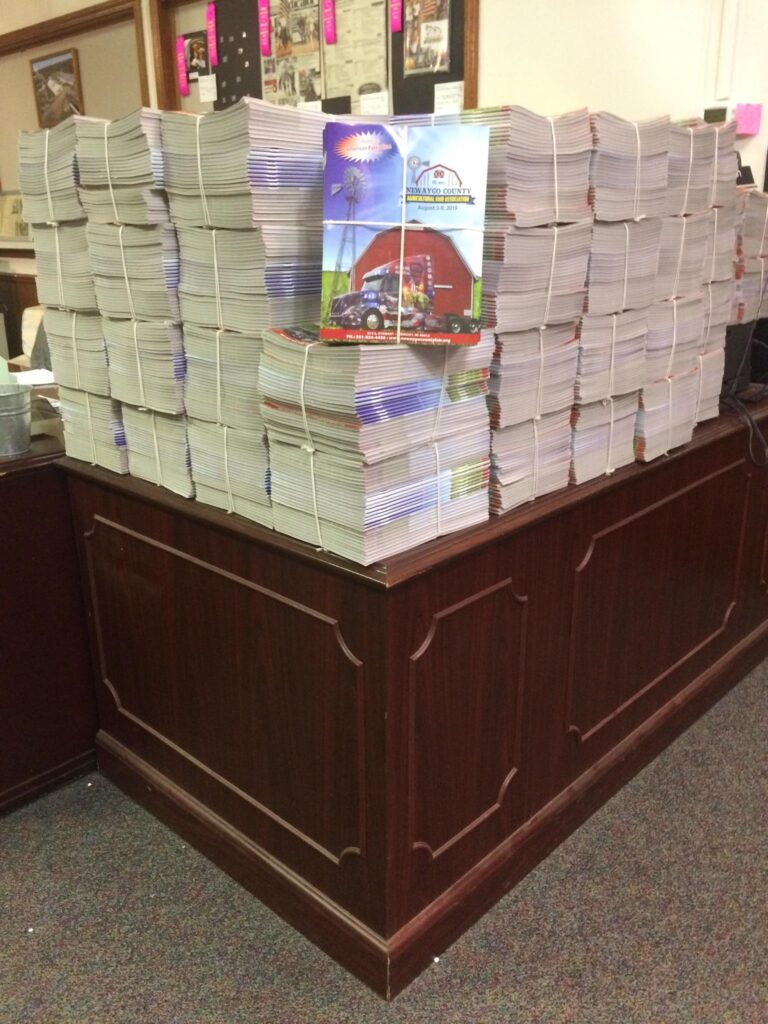

Hey everyone! The day has come! Get your fairbook at the fair office. They are in the box out front and all around the secretary’s desk. While she may enjoy the privacy of her new cubicle walls, she knows it will be a short lived convenience.

With the delivery of the fair books comes the announcement that registration is open. Go to newaygo.fairentry.com and get registered. Please remember to try to avoid using two different usernames for the same person, that only messes up the system and costs the fair extra money. If you can’t register, please give us a call, we’ll help you figure out why.